Home equity percentage calculator

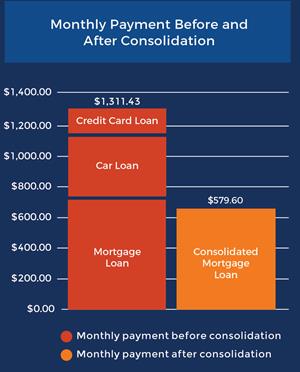

You get the loan for a specific amount of money and it must be repaid over a set period of time. For home-improvers looking for more ways to pay for projects explore all of our home improvement loans.

Home Equity Line Of Credit Qualification Calculator

For example a lenders 80 LTV limit for a home appraised at 400000 would mean a HELOC applicant could have no more than 320000 in total outstanding home.

. Free calculators for your every need. As youre budgeting for a home purchase its wise to plan for between 2 percent and 5 percent of the homes purchase price. If you see an item with an original price of 2499 and the discount is 175 percent you can plug all of those numbers into our calculator and easily find out that the new price is 2062 with a discount of 437.

Call 408-451-9111 or 800-553-0880 or see our current rates. Check terms and rates for a home equity line of credit today. Home equity loans feature fixed rates and a repayment term of up to 30 years.

CLTV is your overall mortgage loan debt expressed as a percentage of your homes fair market value. Subtract from that the amount you owe on your home loan and the remainder is your usable equity. How to Calculate Equity Calculate your equity stake by dividing the loan balance by the market value and then subtracting the result from 1 and converting the decimal to a percentage.

600000 x 80 48000 - 200000 280000. If youre not sure how much youre eligible for use our home equity loan and HELOC amount calculator first. Home equity loans typically range from 5 to 15 years.

With a Home Equity Line of Credit use the equity from your home to pay for your home improvement costs. Bank offers home equity loans and HELOCs without closing costs. Your loan balance would remain the same although the homes value has increased so your home equity would increase too.

Home equity line of credit HELOC calculator. The term of your loan dictates whether you have a high or low monthly payment. Home equity loan rates start at 610 APR for both 10 and 15-year term repayment periods while HELOC variable rates begin at 570 APR and go up to 1010 APR although this may vary with Prime Rate.

Weve developed a useful home equity calculator to help you work out your equity. You typically repay the loan with equal monthly payments over a fixed term. Loan-to-value ratio LTV is the percentage of your homes appraised value that is borrowed - including all outstanding mortgages and home equity loans and lines secured by your home.

The APR will vary with Prime Rate the index as published in the Wall Street. Find the right online calculator to finesse your monthly budget compare borrowing costs and plan for your future. Understand how they differ so you can make the right choice.

Home Equity Lines of Credit Calculator Why Use a Heloc. Home Equity Loans What is a home equity loan. So let say you own a property with a market value of 600000 and you owe 200000 on it.

Rate and payment shown above are based on current offered rates. Banks home equity loan calculator. What is a HELOC.

You can use the mortgage calculator to determine when youll have 20 percent equity in your home. Get home equity loan payment estimates with US. How to borrow.

Your usable equity is. To access a HELOC you need to have the corresponding equity available in your property. Our calculator even works with fractions of percentages.

HELOC Calculator How much home equity can you access. Home equity loan and HELOC guide. Line of credit calculator.

If your home is worth 100000 and you owe 40000 on your mortgage then. Revolving credit line based. Multiply your homes value 350000 by the percentage you can borrow 85 or 85.

All home equity calculators. Contact us online Home Equity Credit Line Fixed 12 month introductory period. If your home is in one of the states listed above you have a credit score above 500 and a loan-to-value ratio below 75 you should be eligible for an investment from Unlock.

This is the annual interest rate youll pay on the loan. To apply for a Home Equity Loan submit an online application Opens a new window. 1st or 2nd mortgages over 7500 up to 300000.

Most home equity lenders allow you to borrow a certain percentage of your home equity typically up to 85 percent. That is the value of equity in your home that you currently own must be higher than the amount you wish to borrow. Home equity loan calculator.

Obtaining the best rate also requires the following criteria to be met. Most HELOC providers allow you to borrow up to a maximum of 85 of the value of your home minus the amount you owe. How to get started.

Enter your loan term. A home equity line of credit is a type of revolving credit in which the home is used as collateral. What is a home equity loan.

A home equity loan is an installment loan based on the equity of the borrowers home. We absorb all costs associated with establishing your loan which generally. You may be able to access funds you didnt realize you had in the form of a home equity loan or line of credit as long as you have some equity in your home.

Most lenders allow you to borrow only a percentage of your homes equity in the form of a home equity loan or. Enter your loans interest rate. Alternately you can ditch the math and use our home equity loan calculator.

The Annual Percentage Rate APR is variable and is based upon an index plus a margin. A Trustco home equity loan or line of credit allows you to borrow the money you need for home improvements a new car the boat youve always wanted and so many other important purchases. So if youre buying a 400000 home your closing costs might.

Home Equity Line of Credit. Thats the magic number for requesting that a lender waive its private mortgage insurance requirement. 1 A new home equity line of credit application 2 A line amount of 200000 or more 3 Line must be in first lien position 4 Having a Citizens consumer checking account set up with automatic monthly payment deduction at the time of origination 5 A loan-to-value LTV of 80 or less 85 or less in Michigan and.

A home equity loan sometimes called a second mortgage is a loan thats secured by your home. Home equity loan rates are between 35 and 925 on average. Discover Home Loans offers 10 15 20 and 30 year home equity loans in amounts from 35000 to 300000.

Home equity loan requirements. To view Home Equity Loan rates visit our Home Equity Loans. Because the home is more likely to be the largest asset of a customer many homeowners use their home equity for major items such as home improvements education or medical bills rather than day-to-day expenses.

Home Equity Line Of Credit Heloc Rocket Mortgage

Mortgage Formula With Graph And Calculator Link

How To Calculate Home Equity Bankrate

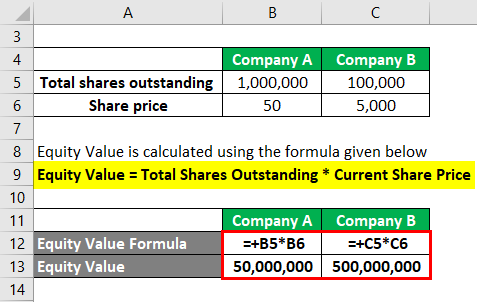

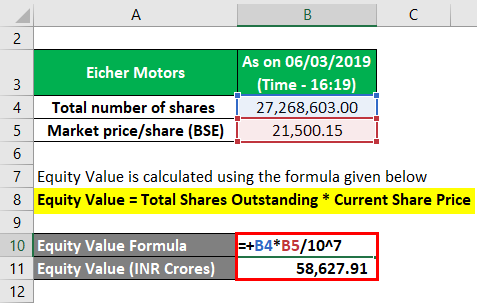

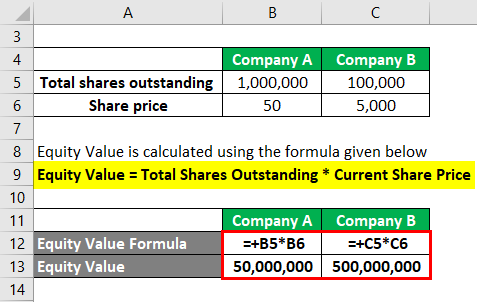

Equity Value Formula Calculator Excel Template

Home Equity Guide Borrowing Basics Third Federal

Heloc Calculator

What Is A Home Equity Line Of Credit Or Heloc Nerdwallet

Home Equity Loan Calculator Nerdwallet

How To Calculate Equity In Your Home Nextadvisor With Time

Home Equity Calculator Free Home Equity Loan Calculator For Excel

Home Equity Line Of Credit Heloc Rocket Mortgage

15 Year Mortgage Calculator Calculate Local 15 Yr Home Loan Refi Payments Nationwide

Home Equity Calculator Free Home Equity Loan Calculator For Excel

Home Equity Line Of Credit Heloc Rocket Mortgage

Equity Value Formula Calculator Excel Template

Home Equity Calculator Free Home Equity Loan Calculator For Excel

Home Equity Calculator Free Home Equity Loan Calculator For Excel